Per Filing

Our Professional Form 941 Filing Team Will Save You Money

Do Not Pay More In Taxes, Tax Preparation, & Filing Fees Than You Have To

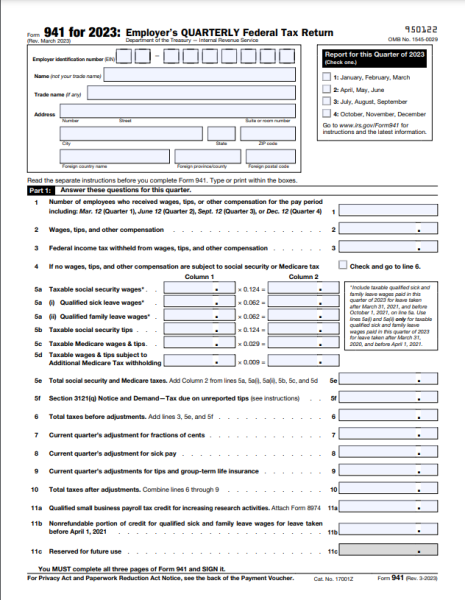

Form 941 is a quarterly tax form used by employers to report wages paid to employees and the amount of taxes withheld from their paychecks. It is also used to calculate the employer’s portion of Social Security and Medicare taxes. The form is submitted to the Internal Revenue Service (IRS) on a quarterly basis.

The due dates for Form 941, which is the Employer’s Quarterly Federal Tax Return, are generally as follows:

- For the first quarter (January, February, and March): April 30th.

- For the second quarter (April, May, and June): July 31st.

- For the third quarter (July, August, and September): October 31st.

- For the fourth quarter (October, November, and December): January 31st of the following year.

- Our comprehensive tax filing services are designed to help you stay compliant and manage your payroll taxes effortlessly.

Employment Taxes

All calculations in our software are guaranteed accurate

No Hidden Charges

CPA CLINICS provides you with transparent pricing and is amongst the lowest priced service

Tax Accountant Team

An experienced team of CPAs and CAs are here to save your money!

Our Experienced Team Helps You With Form 941 Filing

Employment Taxes

Form 941 Rates

The rates for Form 941 vary depending on the type of employment tax being reported. Here are the current rates in 2023:

Social Security Tax: The Social Security tax rate is 6.2% of wages paid by both the employer and the employee. However, there is a wage base limit, which means that only wages up to a certain amount are subject to this tax. For 2023, the wage base limit is $147,000.

Medicare Tax: The Medicare tax rate is 1.45% of all wages paid by both the employer and the employee. Unlike the Social Security tax, there is no wage base limit for Medicare tax. Additionally, there is an Additional Medicare Tax of 0.9% that applies to wages above a certain threshold. For 2023, the threshold is $200,000 for individuals and $250,000 for married couples filing jointly.

Federal Income Tax Withholding: The federal income tax withholding rate depends on the employee's taxable wages and the information provided on their Form W-4. The IRS withholding tables or the percentage method is utilized to calculate the amount of federal income tax to withhold from each paycheck.

Instructions for Form 941

Form 941

Download PDF version of Form 941

Instructions for Form 941

Instructions explaining how to file Form 941

Qualified To Take Care Of You

We Are Certified & Accredited

We take pride in the professionalism of our partners and staff. Our team’s certifications, experience, and positive reviews assure our clients that we can meet our commitment to quality and service and that our professionals serve our clients in a way that is competent, objective and with due professional care.

Get tax Advice On Your SMB or Large Corporation

We are optimists who love to

work together

CPA Clinics

Make Better Business Decisions With Us