Per Filing

Our Professional W3 Form Filing Team Will Save You Money

Do Not Pay More In Taxes, Tax Preparation, & Filing Fees Than You Have To

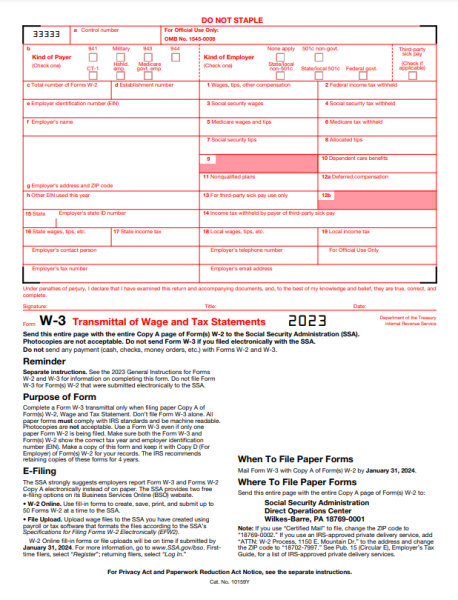

W3 Form is a transmittal form that summarizes the information from the W-2 forms you’ve issued to your employees. It is typically filed with the Social Security Administration (SSA) along with the W-2 forms. By filing the W3 Form, employers provide the SSA with a comprehensive overview of their employees’ earnings and tax withholdings for the year. This information is used by the SSA to ensure accurate reporting of Social Security benefits and to reconcile the data with individual tax returns filed by employees.

The deadline for filing the W3 Form depends on the type of filer you are. If you are filing electronically, then the deadline is January 31 of the year following the tax year being reported. If you are filing by paper, then the deadline is the last day of February of the year following the tax year being reported. The penalty for late filing for small businesses (those with average annual gross receipts of $5 million or less) is $50 per W-2 if you file within 30 days of the due date, with a maximum penalty of $556,500 per year, $110 per W-2 if you file more than 30 days after the due date but before August 1, with a maximum penalty of $1,669,500 per year, or $280 per W-2 if you file on or after August 1 or do not file at all, with a maximum penalty of $3,339,000 per year.

Employment Taxes

All calculations in our software are guaranteed accurate

No Hidden Charges

CPA CLINICS provides you with transparent pricing and is amongst the lowest priced service

Tax Accountant Team

An experienced team of CPAs and CAs are here to save your money!

Our Experienced Team Helps You With W3 Form Filing

Professional W3 Form Filing

Benefits

Professional W3 Form filing is crucial for several reasons. Firstly, it ensures accuracy by summarizing and transmitting employee wage and tax information to the SSA, reducing the chances of errors or discrepancies. Secondly, it helps employers stay compliant with tax regulations as filing the W3 Form is a legal requirement. Failure to file or submitting an incorrect form can result in penalties and fines from the IRS and SSA. Thirdly, hiring professionals who specialize in W3 Form filing saves time and effort, allowing employers to focus on other important aspects of their business. Our professional team has expertise in tax regulations, ensuring that forms are prepared accurately and in accordance with the latest guidelines. Lastly, outsourcing W-3 Form filing to professionals provides peace of mind, knowing that tax forms are being handled by experts and reducing the risk of errors. Overall, our professional W-3 form filing helps ensure accuracy, compliance, and saves time, allowing employers to effectively run their businesses.

Instructions for W3 Form

W3 Form

Download PDF version of FW3 Form

Instructions for W3 Form

Instructions explaining how to file W3 Form

Get tax Advice On Your SMB or Large Corporation

We are optimists who love to

work together

CPA Clinics

Make Better Business Decisions With Us