Per Filing

Our Professional Form 940 Filing Team

Will Save You Money

Do Not Pay More In Taxes, Tax Preparation, & Filing Fees Than You Have To

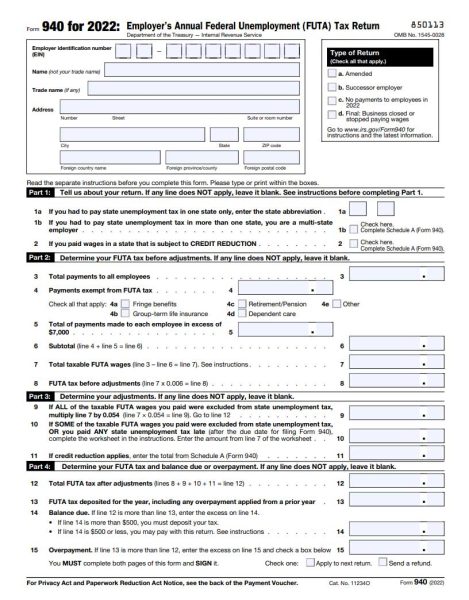

The Form 940 is filed annually and is due by January 31st of the following year. It is used to calculate the amount of FUTA tax owed by the employer based on their taxable wages and other factors. The form also includes information about any state unemployment taxes paid by the employer. Few common challenges that employers may face when filing Form 940 are:

Employment Taxes

All calculations in our software are guaranteed accurate

No Hidden Charges

CPA CLINICS provides you with transparent pricing and is amongst the lowest priced service

Tax Accountant Team

An experienced team of CPAs and CAs are here to save your money!

Our Experienced Team Helps You With Form 940 Filing

1. Employers must file Form 940 if they paid wages of $1,500 or more in any calendar quarter during the current or previous year, or if they had one or more employees for at least some part of a day in any 20 or more different weeks in the current or previous year.

2. We will collect the required information, including your employer identification number (EIN), total wages paid to employees, any exempt wages, and any FUTA tax already paid and will calculate your FUTA tax liability based on the instructions provided with Form 940. The tax rate is 6% on the first $7,000 of each employee's wages, but you may be eligible for a credit of up to 5.4% if you paid state unemployment taxes on time.

3. Fill out the Form 940 accurately and completely, providing the requested information, including your business details, wages paid, and any FUTA tax owed or already paid.

4. There are two options for filing Form 940. We can either mail it to the appropriate IRS address or file it electronically using the IRS e-file system. Electronic filing is generally faster and more convenient.

5. If you owe FUTA tax, then make sure to pay it by the due date. You can pay electronically using the Electronic Federal Tax Payment System (EFTPS), by credit or debit card, or by check or money order. If your FUTA tax obligation exceeds $500 for the entire year, then you are required to make at least one quarterly payment. However, if your FUTA tax liability is $500 or less in a particular quarter, then you can carry it over to the following quarter.

Instructions for Form 940

Form 940

Download PDF version of Form 940

Instructions for Form 940

Instructions explaining how to file Form 940.

Get tax Advice On Your SMB or Large Corporation

We are optimists who love to

work together

CPA Clinics

Make Better Business Decisions With Us