Gambling Winnings and Losses

Reporting. You cannot reduce gambling winnings by gambling losses and report the difference. You must report the full amount of all gambling winnings as income and can claim gambling losses (up to the amount of gambling winnings) only if you itemize deductions. Therefore, records need to show winnings separate from losses. Losses in excess of winnings are not deductible and cannot be carried over to another year.

Lotteries and raffles. Winnings from lotteries and raffles are gambling winnings. In addition to cash winnings, you must include in your income the fair market value of bonds, cars, houses, and other noncash prizes.

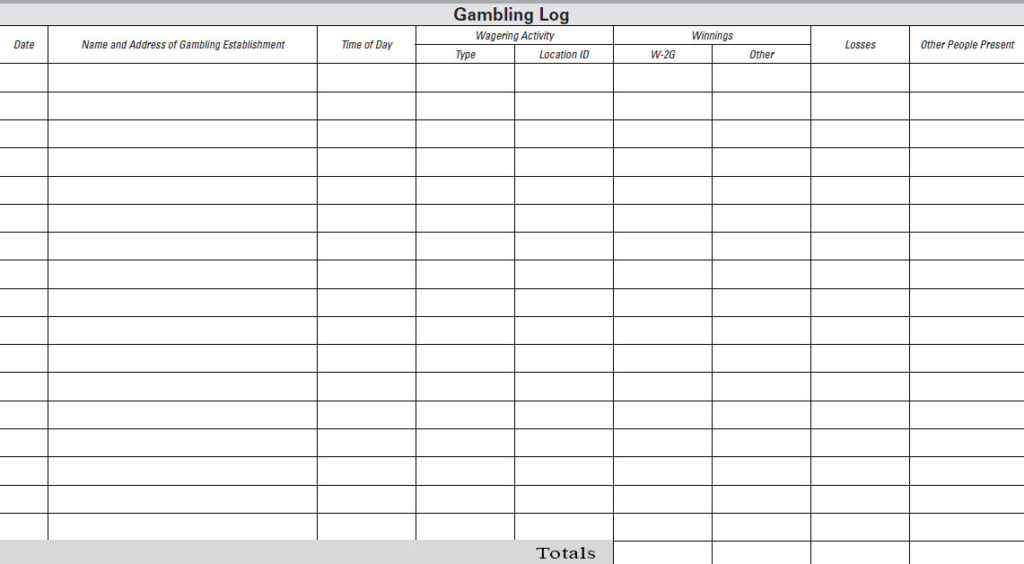

Diary of winnings and losses. You must keep an accurate diary, log, or similar record of losses and winnings. The diary should contain at least the following information.

- The date and type of specific wager or wagering activity.

- The name and address or location of the gambling establishment.

- The names of other persons present with you at the gambling establishment.

- The amount(s) won or lost.

Proof of winnings and losses. In addition to the diary, you should also have other documentation to establish proof of winnings and losses.

- Form W-2G, Certain Gambling Winnings.

- Form 5754, Statement by Person(s) Receiving Gambling Winnings.

- Wagering tickets, cancelled checks, substitute checks, credit records, bank withdrawals, and statements of actual winnings or payment slips provided by the gambling establishment.

Withholding. Income tax is withheld at a flat 24% rate from gambling winnings more than $5,000 from:

- Any sweepstakes, wagering pool, including payments made to winners of poker tournaments, or lottery.

- Any other wager, if the proceeds are at least 300 times the amount of the bet.

It does not matter whether your winnings are paid in cash, in property, or as an annuity. Winnings not paid in cash are taken into account at their fair market value.

Exception: Gambling winnings from bingo, keno, and slot machines generally are not subject to automatic income tax withholding. However, you may need to provide the payer with an SSN to avoid withholding.

If you receive gambling winnings not subject to withholding, you may need to make estimated tax payments. If you do not pay in enough estimated tax, you may have to pay a penalty.