Our Professional Income Tax Services

Will Save You Money

Do Not Pay More In Taxes, Tax Preparation, & Filing Fees Than You Have To

Gather your documents and let our tax professionals do the rest. Just review and approve your return.

With tax preparation and filing fees starting at $50, we are amongst the lowest priced CPA Tax Preparation and Filing Service Providers and are here to assist you to keep more money in your wallet!⠀

Tax

All calculations in our software are guaranteed accurate

No Hidden Charges

CPA CLINICS provides you with transparent pricing and is amongst the lowest priced service

Team Of CPAs

An experienced team of CPAs and CAs are here to save your money!

What is Tax Management?

“Taxes are the prices we pay for a civilized society,” Oliver Wendell Holmes – U.S. Supreme Court Justice

Americans spend 29.2 percent in taxes each year when each tax is equated – Local Income Tax, State-Tax, Federal Tax (Corporate and Individual); Excise Tax, Social Security Tax, Property Tax, and others. There are a few basic categories into which a lot of different types of taxes fall such as tariffs on goods and services, taxes on income, and taxes on the property.

As citizens of a country or conducting business in the country, we have to pay federally imposed taxes to fund the government expenses for various public expenditures, federal affairs of a state, and stay in compliance and “good standing” with the regulatory bodies. Our taxation system is vital for the economy of the country.

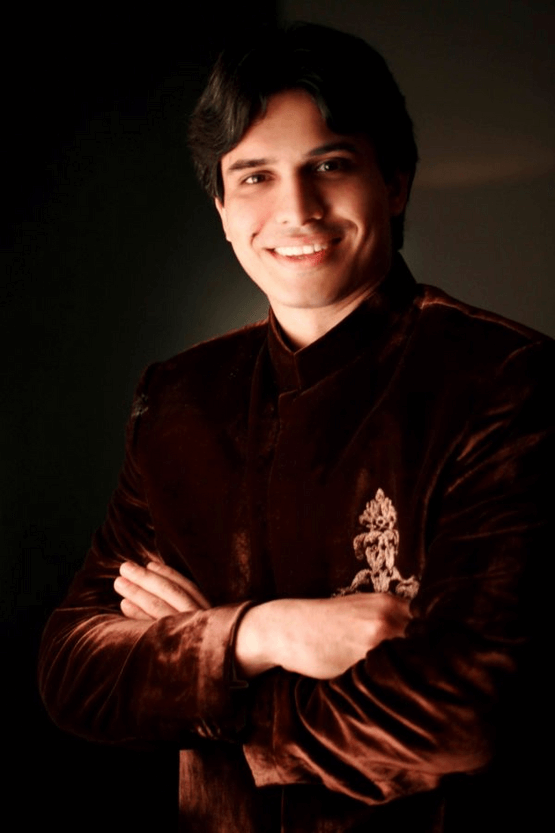

About The CEO – The Professional Certified Public Accountant

Arjumand J. Khan (Shan/A.J.) is the CEO and a licensed Certified Public Accountant with years of experience in Budget Analysis, Financial Audits, Internal Audit, SOX Compliance, Financial Management, Corporate Tax, Individual Income Tax, Tax Dispute, Credit Repair, Accounting, and other services.

He is an accomplished tax professional with over 20 years of knowledge managing tax planning, preparation, and filing. He is an expert in federal, state, and local tax principles and for applying optimal procedures for filing and paying these authorities. He is also experienced in handling IRS communications and audits, and is known for having exceptional aptitude to solve tax-related problems efficiently and creatively.

Our Experienced Team Can Help You

Taxes are a necessary part of life, but they don't have to be such a burden. As a Certified Public Accountant (CPA) and Chartered Accountant (CA) firm, we understand your concern. You can hire our services for better tax management. We can bring about and formulate your tax in a way that assess and utilize all the deductions and credits available to you - both today and in the future.

Hiring our professional income tax services means that you will have a team of CPAs, CAs, and tax planners with you, and they will do all the work for you, from planning tax year to year to submitting the returns. Consider long-term taxable effects of your asset and retirement savings. Doing so means that you will have tax control in retirement when you need it most.

Why Hire CPA CLINICS As Tax Management Partner?

CPA CLINICS has a full range of tax and legal services, covering all taxation aspects ranging from income tax to corporate tax management.

With an in-depth industry knowledge of taxation, we employ the market’s leading professional tax providers. This is to deliver appropriate tax and legal solutions, use innovative tax strategy and planning measures, help our clients manage risk, and keep us always prepared to provide you with advanced tax services.

Our Key Income Tax Services

Tax Mergers And Acquisitions (M&A)

Our tax planning services providers can contribute to your business with their achievements, tax deal organizing and planning, post transactions integration, mergers and amalgamations, and due diligence. Our professional services include:

Tax Due Diligence: We have experience in providing buy-side tax and sell-side tax due diligence to our clients. Our tax experts team starts its analysis systematically to focus and quantifying tax risks and opportunities. With our team, you will manage risk better and the company's assets positions to sell.

Deal Structuring:

Our tax management services' organized guidance is provided at the pre-acquisition, contract execution, and post-deal incorporation stages. Our guidance focuses on managing the group tax rate from going sky-high, on top of classifying and implementing the necessary pre-transaction reshuffles. Our post-deal amalgamation services help prepare a plan post-transaction to deliver the tax value from the transaction.

Support Services:

You will get complementary best customer support services that address the legal matters during the M&A process.

Tax Structuring: Approachable and well-organized tax structuring techniques and guidance specifically catered by the tax planning services providers to reduce direct or indirect tax costs. Let CPA Clinics contribute with:

- International Tax Planning

- Value Chain Transformation

- Tax-Efficient Group Restructuring

- Align Tax / Fiscal And Operational Models

- Finance And Capital

- Group Tax Planning

- Attain Justifiable Structural Tax Perfections, Increase Stakeholder Value And Cash Flow

Tax Reporting And Strategy

CPA CLINICS helps you bring together tax function structure, compliance delivery, and technology to assist you to manage your current and future challenges head-on.

Tax Strategy And Operations

The rapidly changing tax landscape is the biggest concern of business owners and senior management. The whole landscape is shifting their focus on how their current business strategy aligns with their company’s vision and goals.

The regulatory bodies and other governments department expect businesses to manage their tax risks aptly. That’s where CPA CLINICS, the tax planning services provider, comes in with up-to-date technology to keep a record of even minuscule changes in your corporate tax management.

Business Process Outsourcing Services

We can assist you to focus on your core activities, so that you can more optimally achieve your business goals. Some of the fields that we are experts in include:

- Accounting & Bookkeeping

- Financial Services

- Company Filing

- Internal Control

- SOX Compliance

- Internal Audit

- VAT And Withholding Tax Returns

- Payroll Management

WHY CHOOSE US?

CPA CLINICS offers tax preparation and filing services at unbeatable prices!

Collaboration

Our expert will have a detailed meeting with you to understand your requirements.

Income Tax Manager

CPA CLINICS will assign a dedicated Income Tax Manager for you.

Timely Filing

Electronically and securely submit information to us for timely filing.

TAX MANAGEMENT

PRICING MODEL

(Additional $100)

Credits And Adjustments

Rental Property

1099 - Non Employee Income

And Schedule K-1

(Additional $99)

(Additional $99)

(Additional $99)

(Additional $99)

(Additional $45)

(Additional $45)

C Corporations

Partnerships

And LLCs

CPA Clinics

Make Better Business Decisions With Us